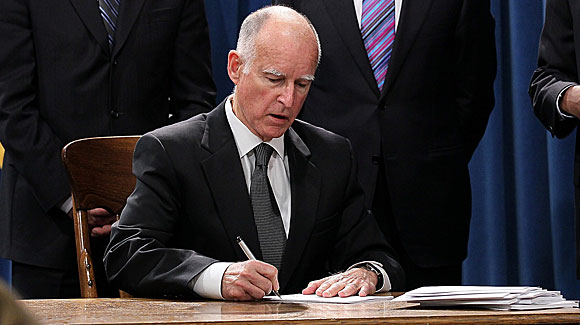

The California Film & Television Job Retention and Promotion Act (Assembly Bill 1839), was signed into law by Governor Brown on Sept. 18, 2014.

The California Film Commission is currently developing regulations, program guidelines and other procedures to administer the newly expanded tax credit program. Please check the CFC website periodically for program updates.

The legislation creates a new five-year film and TV tax credit program (Program) beginning in fiscal year 2015/16 with expanded eligibility to include big-budget feature films, 1-hr TV series (for any distribution outlet) and TV pilots. Funding for the new program is $230 million in fiscal year 2015-16, and $330 million per fiscal year from 2016-17 through 2019-20. This legislation replaces the current lottery system for allocating tax credits with a jobs-based ranking system.

Key changes from prior law:

The California Film & Television Job Retention and Promotion Act:

- Increases tax credit program funding from $100 million to $330 million per fiscal year.

- Expands eligibility to big-budget feature films, 1-hr TV series (for any distribution outlet) and TV pilots.

- Eliminates budget caps for studio and independent films. While there is no cap, tax credit eligibility will apply only to each project’s first $100 in million in qualified spending (for studio films) or the first $10 million (for independent films).

- Eliminates the state’s existing tax credit lottery. Projects will instead be selected based on a “jobs ratio” formula and other ranking criteria. Projects will be ranked within specific categories (i.e., TV projects will compete against TV projects; independent films against independent films, etc.)

- Includes penalty provisions for projects that overstate job creation.

- Provides for multiple allocation periods throughout the year. Instead of a single allocation period annually, there will be one or more allocation periods in Program Year 1, and two or more allocation periods in Program Years 2 – 5. Application period schedules and instructions are under development.

- Adds 5% “Uplift” for productions that film outside of the 30-Mile Zone and for visual effects and music scoring/recording performed in-state.

A detailed summary of the new Program is available on the CFC website – AB 1839 Tax Credit Program Summary